Depreciation charge calculator

Where A is the value of the car after n years D is the depreciation amount P is the purchase. If your asset needs depreciating for more than 5 years calculate.

How To Calculate Depreciation Expense Accounting Basics Cpa Exam Content Writing

D P - A.

. The Car Depreciation Calculator uses the following formulae. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. A P 1 - R100 n.

Of course you will still be able to sell it to individual buyers but its. Find the depreciation rate for a business asset. This limit is reduced by the amount by which the cost of.

You can use this tool to. First one can choose the straight line method of. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation.

Calculate depreciation for a business asset using either the diminishing value. Our car depreciation calculator assumes that after approximately 105 years your car will have zero value. The Depreciation Calculator computes the value of an item based its age and replacement value.

Non-ACRS Rules Introduces Basic Concepts of Depreciation. This depreciation calculator will determine the actual cash value of your Computers using a replacement value and a 4-year lifespan which equates to 004 annual depreciation. The double declining balance calculator also uses the same.

You can browse through general categories of items or begin with a keyword search. For example if you have an asset. It provides a couple different methods of depreciation.

Depreciation Expense 2 x Cost of the asset x depreciation rate. To use the calculator you will need to enter the value of the asset and then the percentage of depreciation for each year. To use the calculator simply enter the purchase price of the car and the age at which the car was when it was purchased by you 0 for brand new 1 for 1-year old etc.

Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of SalvageCost 1Life Variable Declining Balance Depreciation. If the computer has a residual value in 3 years of 200 then depreciation would be calculated.

The computer will be depreciated at 33333 per year for 3 years 1000 3 years. Depreciation rate finder and calculator. Section 179 deduction dollar limits.

Percentage Declining Balance Depreciation Calculator. The double declining balance depreciation expense formula is. This depreciation calculator is for calculating the depreciation schedule of an asset.

If you leave the. Calculation of Depreciation Rate The reduction in value of an asset due to normal usage wear and tear new technology or unfavourable market conditions is called.

Units Of Activity Depreciation Calculator Double Entry Bookkeeping

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

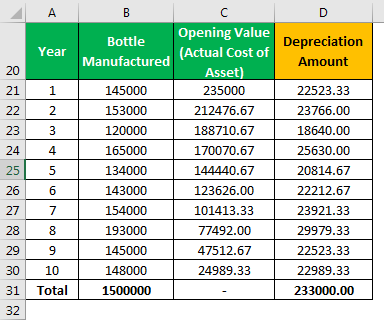

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

How To Calculate Depreciation

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator

Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Car Depreciation Calculator

Depreciation Calculation

Declining Balance Depreciation Calculator

Straight Line Depreciation Calculator Double Entry Bookkeeping

Straight Line Depreciation Formula And Excel Calculator